SENSEX’s latest market structure and pattern development using orthodox NEoWave logic. I track patterns in the stock and crypto charts so you can make informed decisions about future market direction. https://prosdontpanic.com

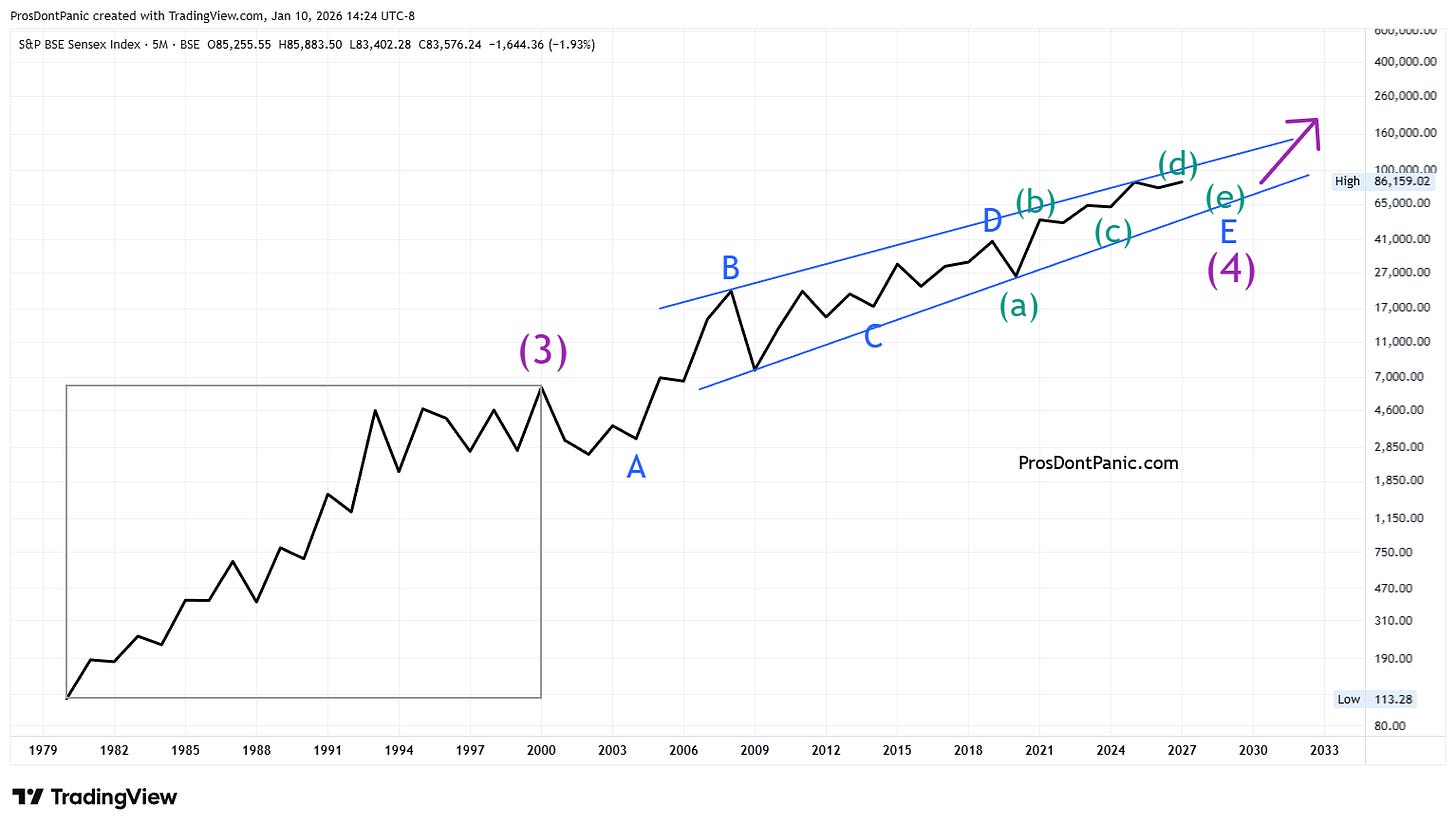

2.5 Yearly Chart

I have marked the end of the bull move as Wave-(3) in 2000. It is possible the bull move ended 8 years earlier in 1992 or 8 years later in 2008. Two things:

1. The sharp move down in 2008 (financial crisis) is certainly a trend wave (wave-A, C or E) and since it was fully retraced we know it can’t be an impulse wave and it must be wave-A or C.

2. By marking wave-(3) in 2000 I have aligned the SENSEX and the NIFTY with the 26-year bear market running correction found in the S&P 500. Now all large indexes are tracking together. We will wait and see if this market reacts with the others.

Major trend (purple)= UP

Minor trend (blue) = DOWN

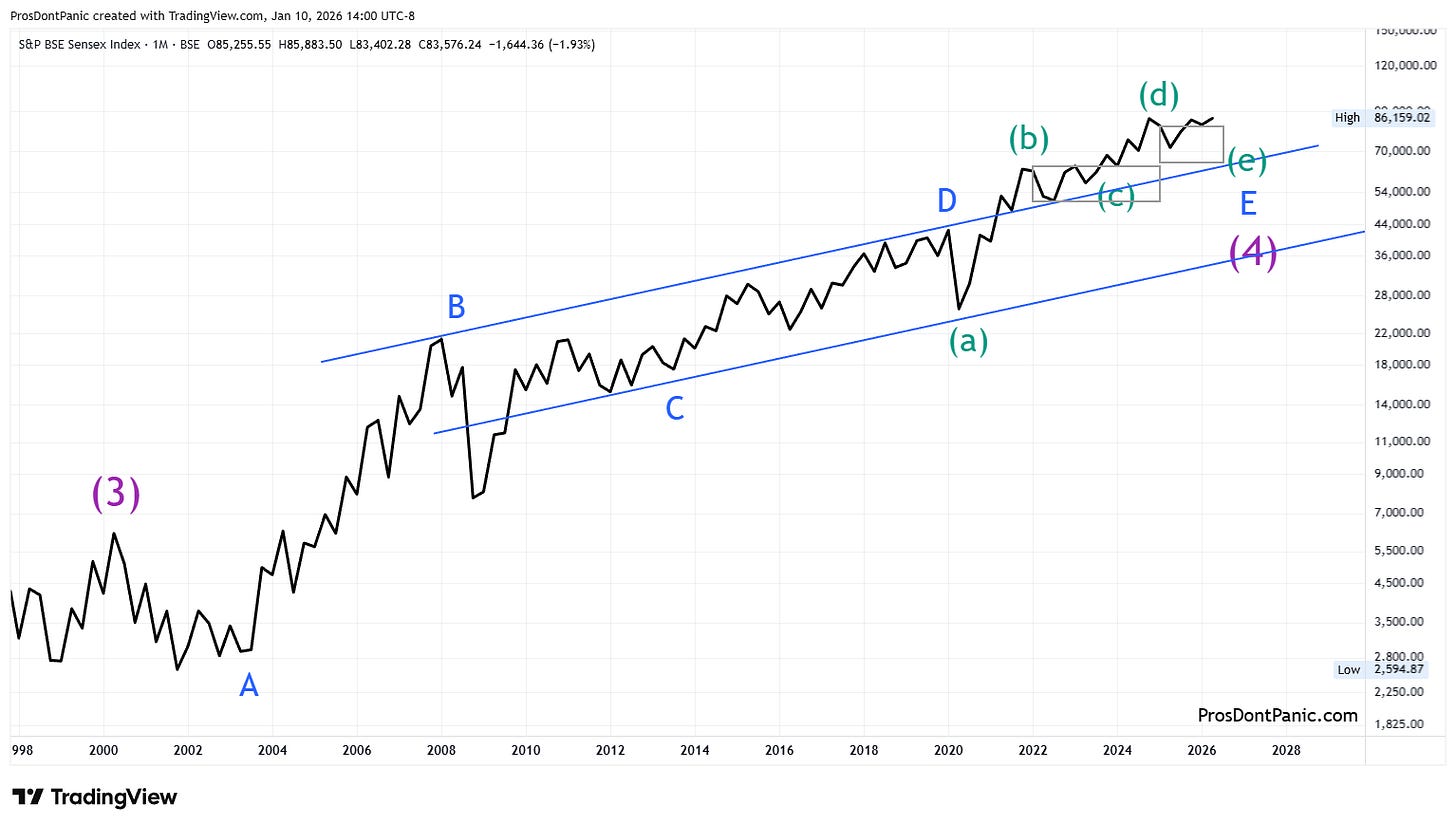

6-Monthly Chart

A closer look at Wave-(4). If wave-E is finishing up as we are expecting, a short but sharp move down to complete wave-(e) of E is needed.

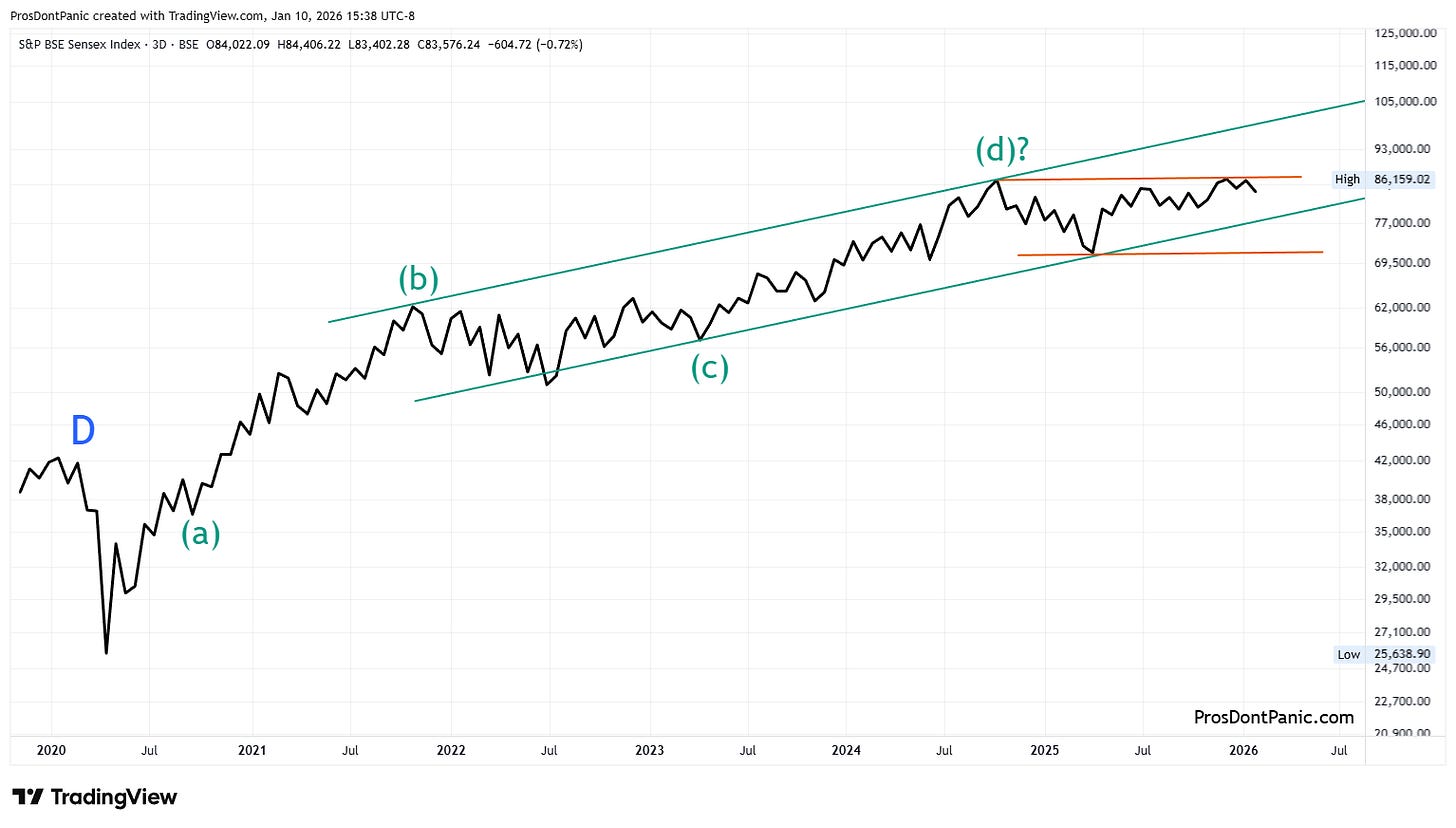

Monthly Chart

Zooming in on Wave-E of (4).

Wave-d has not officially confirmed complete. When it does I will note it in the future Weekly Update.

Expecting one more push down for wave-(e). The market is finishing up a multi-year correction and clarity is not

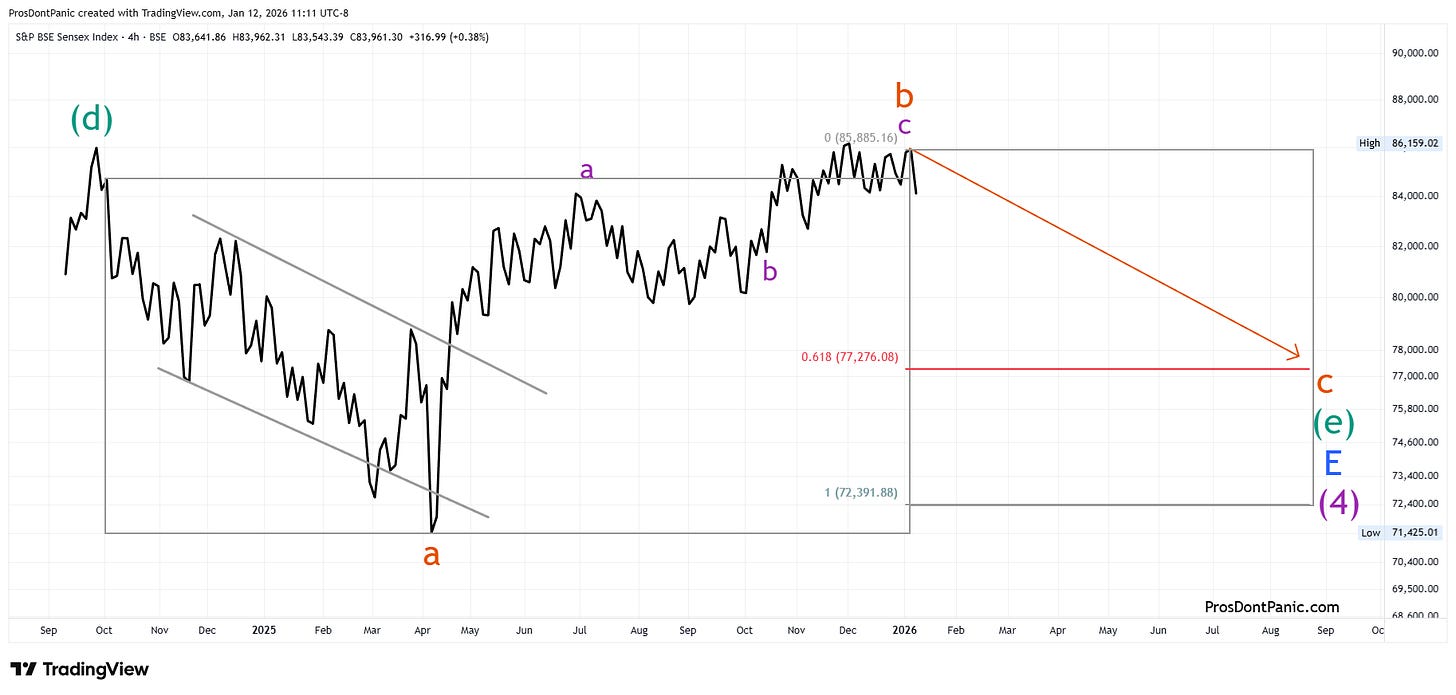

Weekly Chart

A closer look at the developing Wave-(e) of E:

The expected time to complete wave-(e) is shown in the price/time box

As for price, this pattern is a running correction and there is no guarantee the market will reach the lows shown in the price/time box.

Bottom Line

As currently labelled, SENSEX is in the process of completing a 26-year running bear market correction in line with the NIFTY and S&P 500. We need to get through the end of wave-E of (4) and confirm it has finished before we can declare the real bull market in India has begin. This has not occurred yet. Be patient.

This content is provided for informational and educational purposes only and does not constitute trading, investment, or financial advice. PDP does not provide trade recommendations, entry or exit signals, or portfolio guidance.