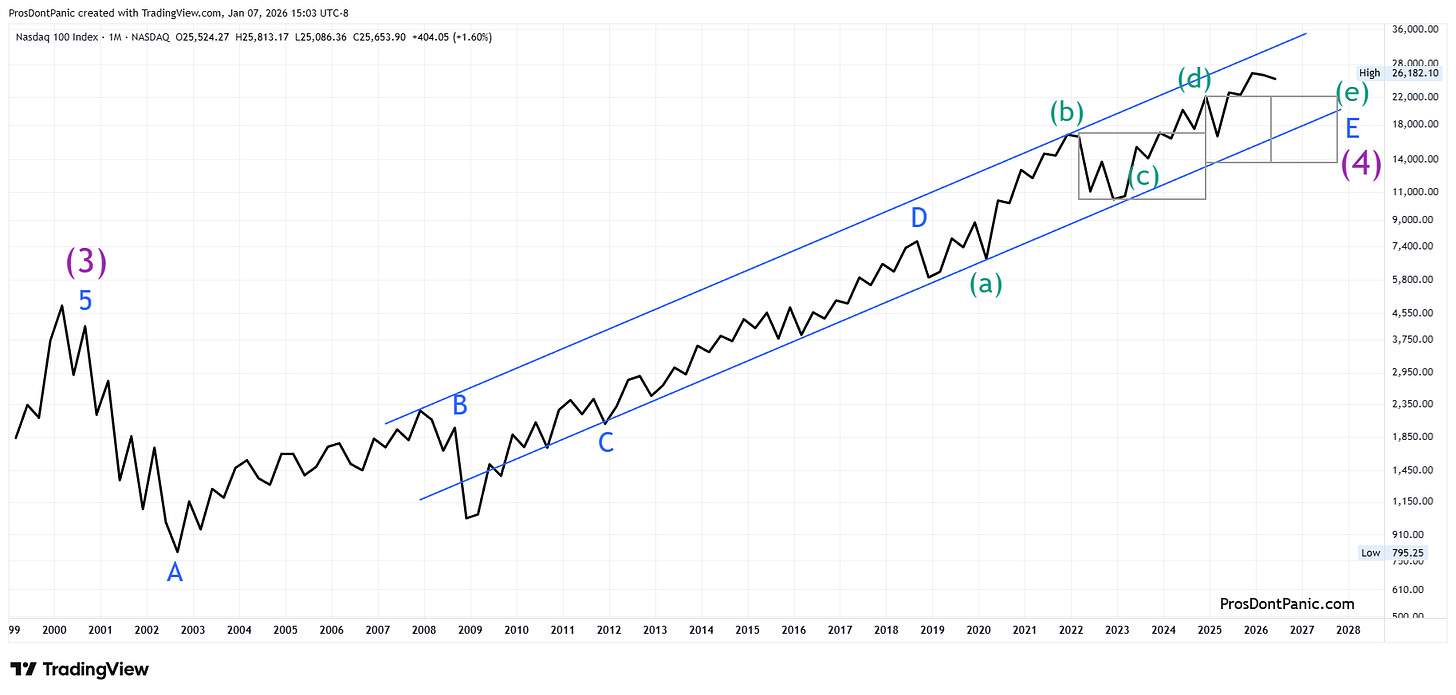

This update reviews the Nasdaq 100’s current market structure and pattern development using orthodox NEoWave logic and analysis.

NDX is completing the same 26-year running bear market correction as the S&P 500 which everyone thought was the “bull market”. We need to get through the end of Wave-(4) then the real bull market will begin.

6-Monthly Chart

A closer look at Wave-(4) shows that wave-E is finishing up a Neutral Triangle. When finished Wave-(5) should commence with all degrees going to the upside and very powerful upside potential.

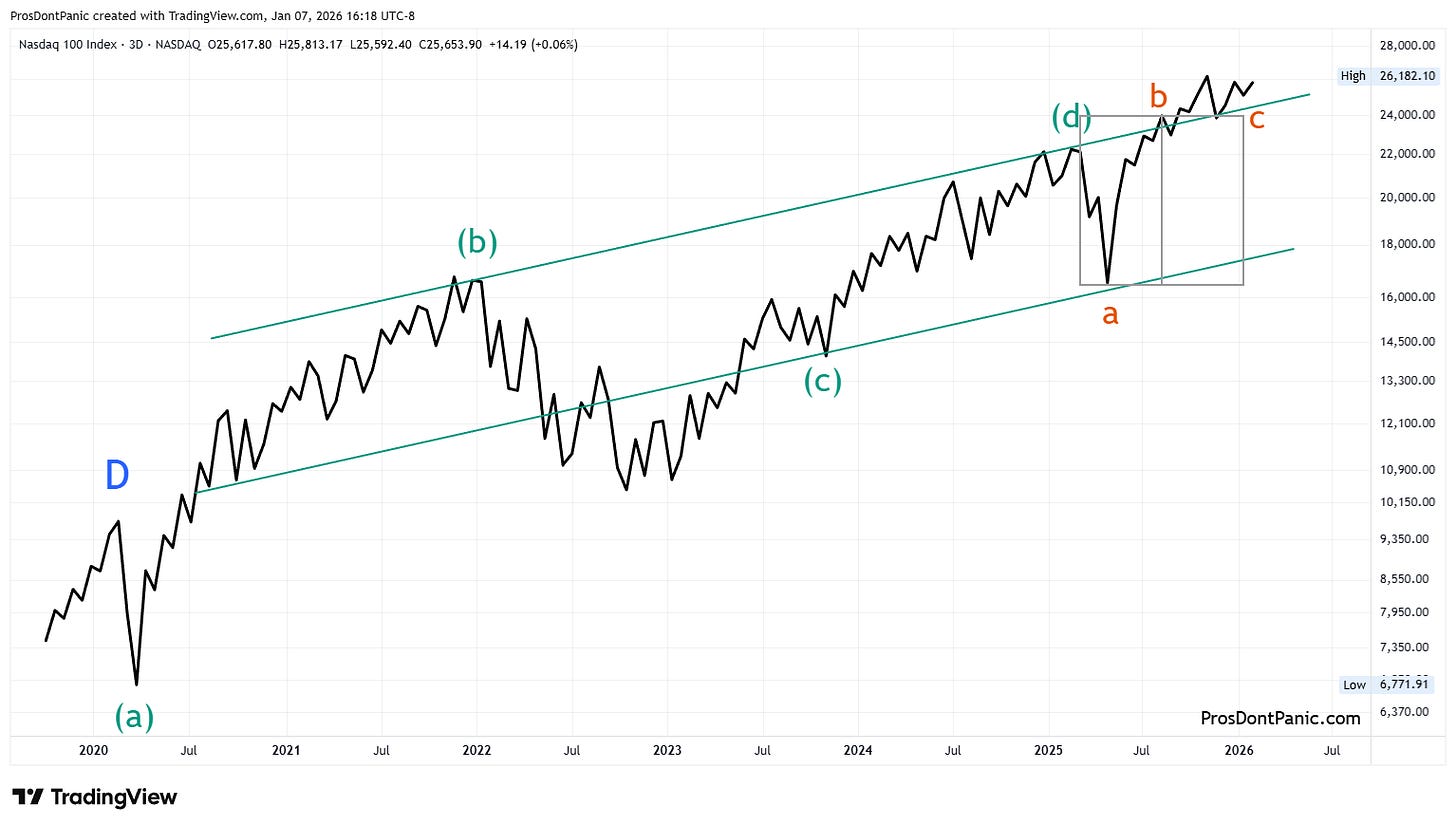

Monthly Chart

Zooming in on Wave-E of (4), yet another Neutral Triangle is forming and nearing completion. Fractals are common as the pattern repeats itself.

Weekly Chart

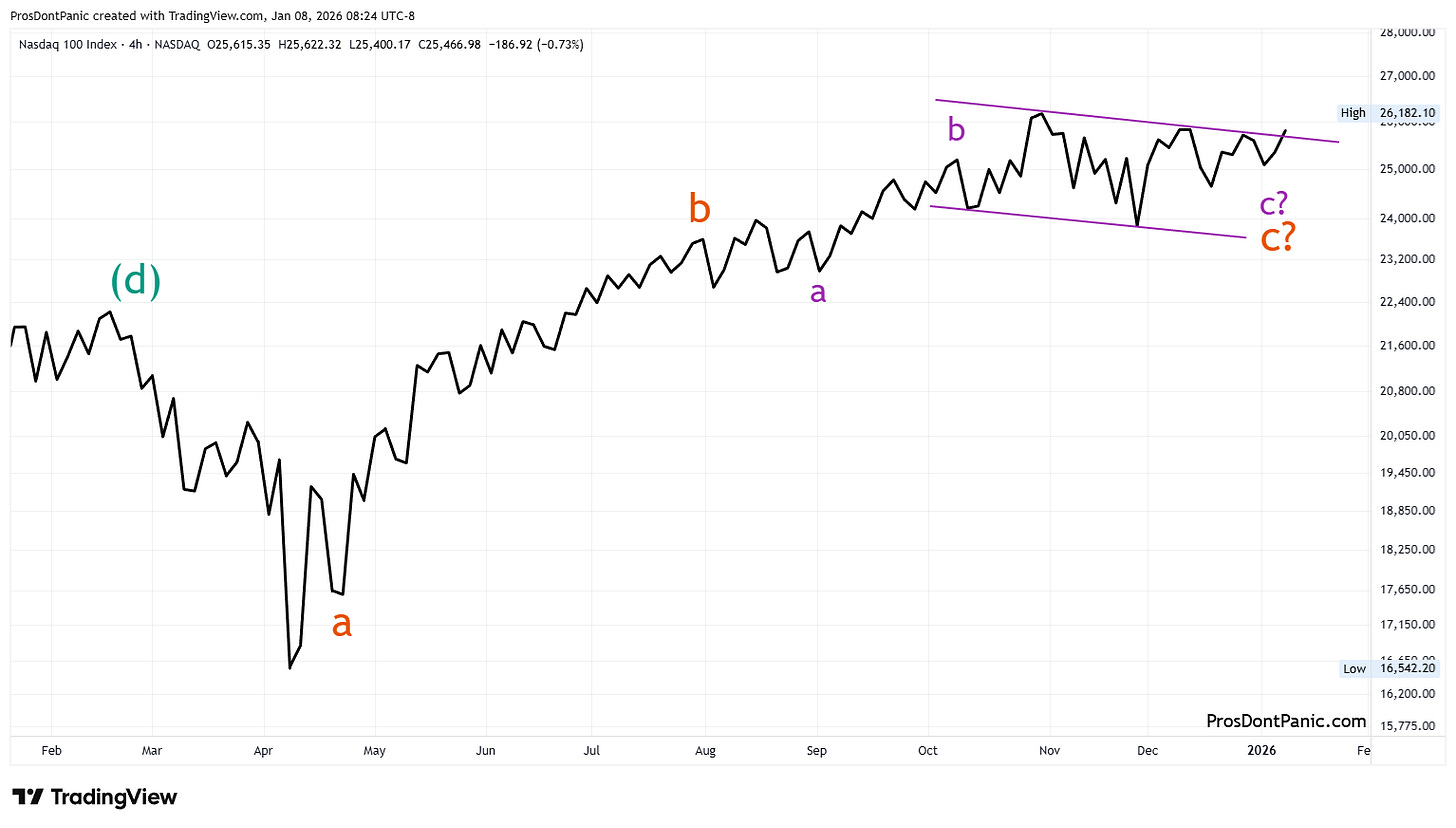

A closer look at the developing Wave-(e) of E:

Wave-b of (e) was a strong running correction lifting the market higher.

Wave-c of (e) appears to confirm complete at the small degree but if the larger (bull) trend is now starting the confirmation will be a large and violent surge upward. This has not occurred yet.

Bottom Line

NDX is completing a 26-year running bear market correction. We need to get through the end of Wave-(4) which is completing wave-E then the real bull market will begin.

This content is provided for informational and educational purposes only and does not constitute trading, investment, or financial advice. PDP does not provide trade recommendations, entry or exit signals, or portfolio guidance.